Dashboard

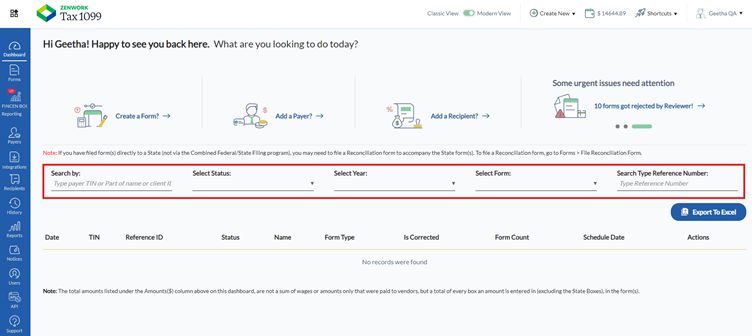

The Dashboard page allows you to create forms, add payers and recipients, and address issues related to TIN verification, IRS-rejected, and review rejected forms.

In Dashboard, the Penalty Risk Status is shown through the Penalty Risk Navigator—a visual tool designed to help you proactively identify and reduce filing risks before submission

You can also search for the required forms by TIN, status, tax year, type, and reference number.

The dashboard now includes new features that allow users to streamline vendor payments through the Payments module, file Beneficial Ownership reports via FinCEN BOIR, and make secure IRS tax payments using the integrated EFTPS system.

Additionally, the Tax1099 dashboard comprises different sections, allowing you to easily access the Tax1099 features without hassle.