Creating Form

The forms are used by the taxpayers to declare the income, expenses, tax deductions, investments, and taxes to the income tax department.

To create a form, perform the following steps:

1. Login to the Tax1099 application.

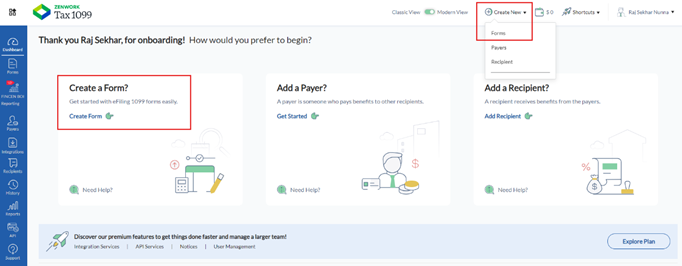

2. On the dashboard, click  Create New, and then select Forms from the list.

Create New, and then select Forms from the list.

Or

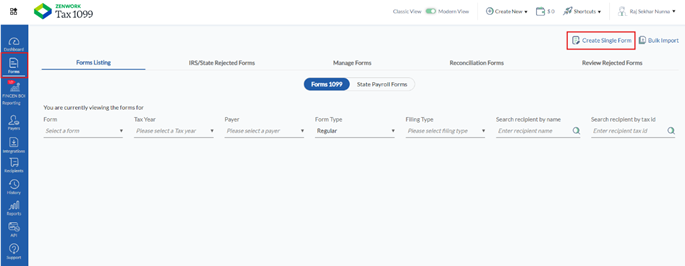

From the left pane, select Forms, and then click Create New Form.

3. Select the type of form you want to eFile. For example, 1099 Forms or State Payroll Forms.

4. If you select 1099 Forms, perform the following steps:

a. Select the appropriate tax year. For example, 2024, 2023, 2022, or 2021.

b. Select the appropriate form that you want to file the tax and then click Next.

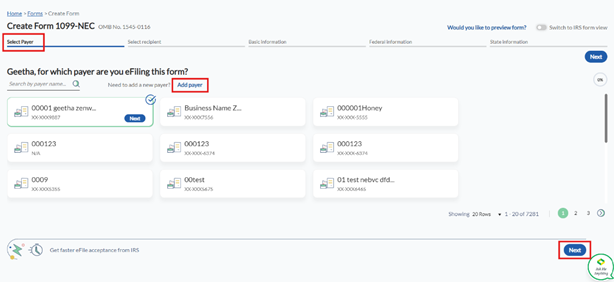

c. On the Select Payer box, select the payer for whom you want to eFile the form.

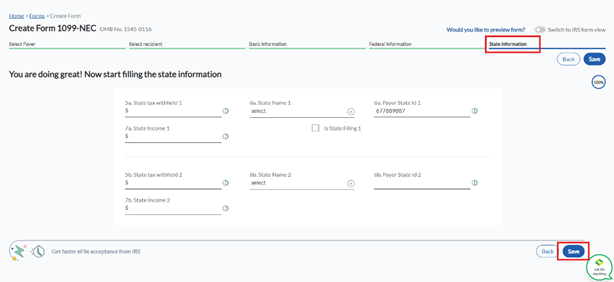

Note: Turn on the Switch to IRS form view toggle to view the form in IRS format.

d. (Optional) Click Add Payer to add a new payer.

e. Click Next.

f. On the Select Recipient box, select the recipient for whom you want to eFile the form.

g. (Optional) Click Add Recipient to add a new recipient.

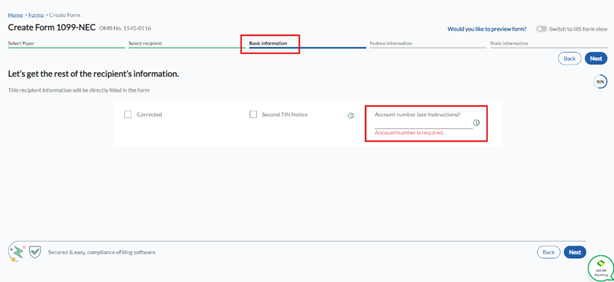

h. Enter the Account Number and State Tax information in the respective boxes.

i. Click Save & Continue.

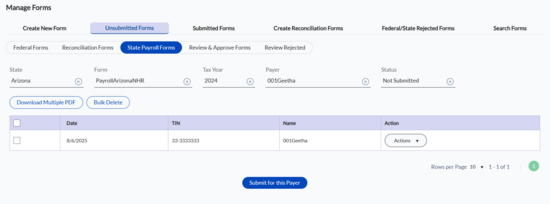

j. The form is successfully filed and added to the Unsubmitted Forms page.

Notes:

· Click View Added Form to view the created form on the Forms Listing page.

· Click Add Another Form to create a new form.

· Click Go to Dashboard to navigate to dashboard.

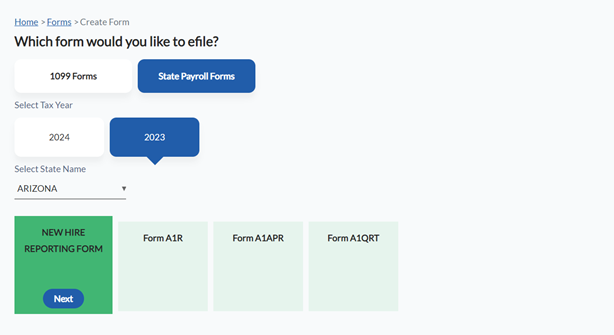

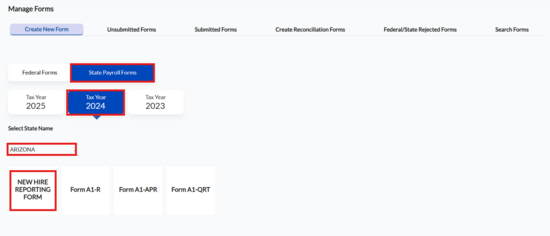

5. If you select State Payroll Forms, perform the following steps:

a. Select the appropriate tax year. For example, 2024 or 2023.

b. Select the state name from the Select State Name list.

c. Select the appropriate form that you want to file the tax, and then click Next.

The respective form page appears in IRS format.

d. Select the payer information under the Employer Information section.

e. (Optional) Click Add to add a new payer.

f. (Optional) Click Edit to edit the payer information.

g. Select the recipient information under the Employee Information section.

h. (Optional) Click Add to add a new recipient.

i. (Optional) Click Edit to edit the recipient information.

j. Enter the required details and then click Next.

The confirmation page appears.

Notes:

· Click View Added Form to view the created form on the Forms Listing page.

· Click Add Another Form to create a new form.

· Click Go to Dashboard to navigate to dashboard.