Add Recipient

To add a recipient, perform the following steps:

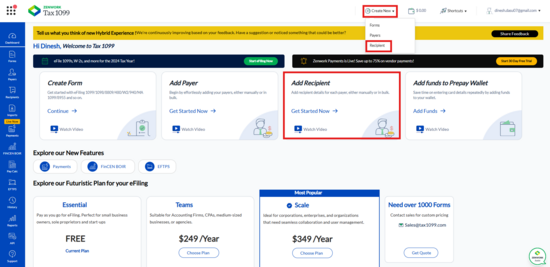

1. Login to the Tax1099 application.

2. On the dashboard, click  Create New, and then select Recipient from the list.

Create New, and then select Recipient from the list.

Or

On the dashboard, click Add a Recipient?

Or

From the left pane, select Recipients.

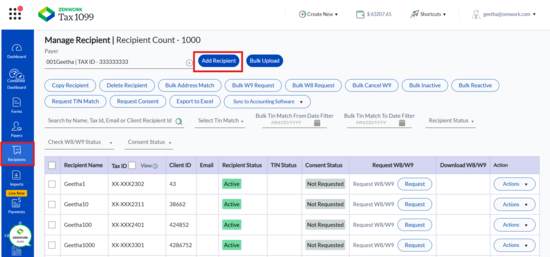

The Manage Recipient page appears, click Add Recipients tab.

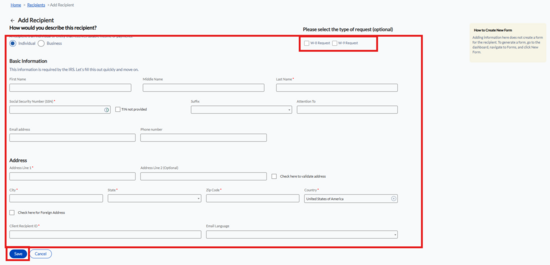

3. The Add Recipients page appears.

4. (Optional) Select the check box for W9 or W8 to send a W9/W8 request to the recipient.

5. Select the type of recipient.

6. If you select Individual as the type of the recipient, the perform the following steps:

-

Enter the Social Security Number (SSN).

-

(Optional) Select the check box TIN Not Provided if the SSN is not provided for the Recipient.

-

Enter the basic information such as Recipient Name, Suffix, address, phone number, email address.

-

(Optional) Validate the address of the Recipient with USPS database by selecting the check box Check here to validate address.

-

(Optional) If the Recipient is a Non-Resident US, you add by selecting the check box Check here for Foreign Address.

-

Click Save.

-

The confirmation message appears on the screen. The recipient is added successfully.7. If you select Business as the type of the recipient, then perform the following steps:

-

Enter the Employer Identification Number (EIN).

-

(Optional) Select the check box TIN Not Provided if the EIN is not provided for the Recipient.

-

Enter the basic information such as Business Name, address, phone number, email address.

-

(Optional) Validate the address of the Recipient with USPS database by selecting the check box Check here to validate address.

-

(Optional) If the Recipient is a Non-Resident US, you add by selecting the check box Check here for Foreign Address.

-

Click Save.

-

The confirmation message appears on the screen. The recipient is added successfully.