Importing Bulk Forms

Bulk importing is the process of uploading multiple tax forms into the Tax1099 system at once. This involves uploading or transferring multiple forms simultaneously, rather than individually, to streamline data entry and management tasks.

Bulk form imports can be performed by:

· Downloading a template (XLS or CSV) from the Tax1099 platform.

· Filling out the template with the required information for each form.

· Uploading the completed template back to the platform.

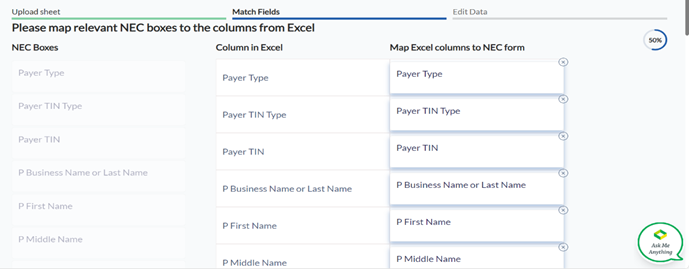

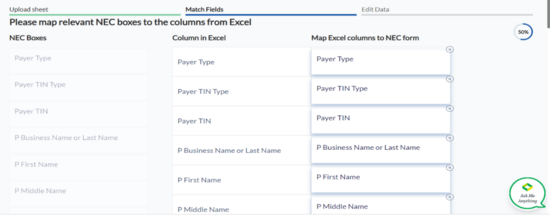

· Mapping the columns in the template to the corresponding fields in the tax form.

· Reviewing and correcting any missing or incomplete information.

· Submitting the forms in bulk for filing with the IRS.

To bulk import the forms, perform the following steps:

1. Login to the Tax1099 application.

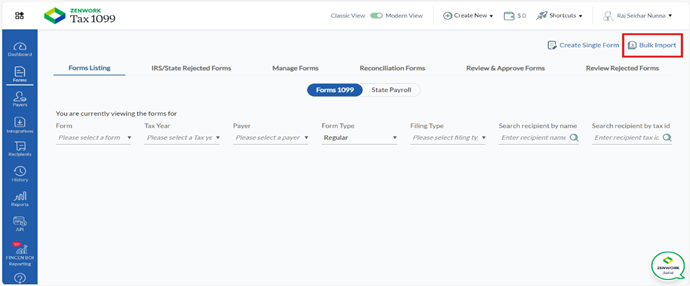

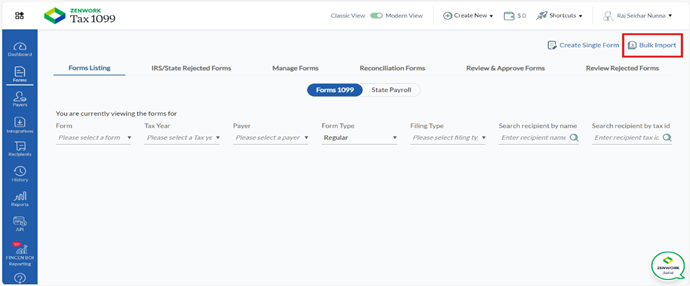

2. From the left pane, select Forms, and then click Create New Form.

Or

From the left pane, navigate to Integrations, and then click Import from Excel.

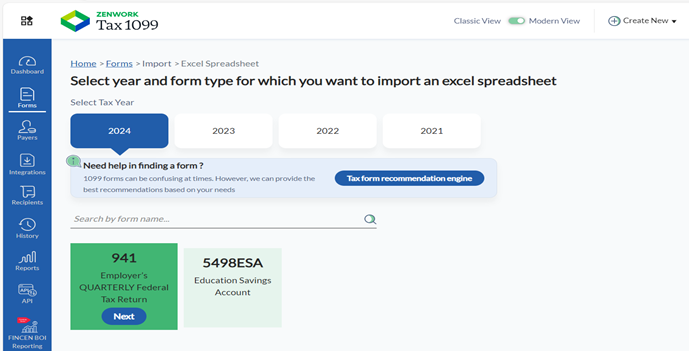

3. Select the year and form type for which you want to import an Excel spreadsheet.

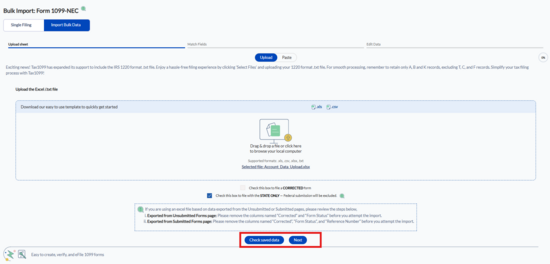

4. The Form 1099-NEC appears. Click Import Bulk Data.

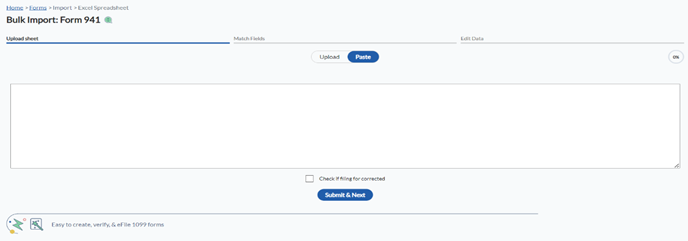

5. Drag and drop or browse and select a file from your local system for bulk upload.

Or

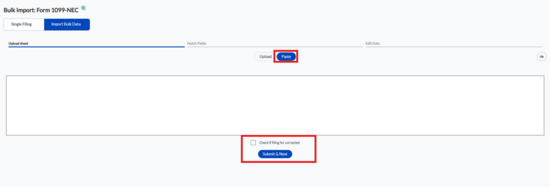

Select the Paste tab to paste the copied data.

6. (Optional) Select the Check if filing for corrected check box if the filing form needs a correction.

7. (Optional) Click Check Saved Data to verify the saved data.

8. Click Next.

9. Verify each column against the respective form.

10. Click Next.

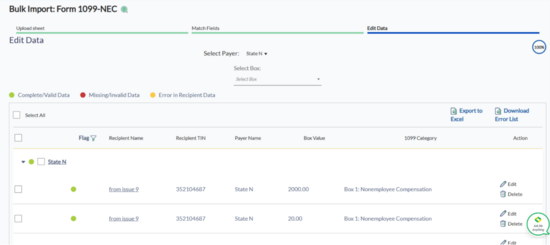

The Edit Data page appears.

11. (Optional) Select the payer and edit the details if required.

12. (Optional) Click Export to Excel to export the data in .xls format.

13. Select the record you want to submit, and then click Submit.

The imported record is added under the Form Listing tab for submission.

Note: For more information on submitting the 1099 or State Payroll forms, see Submitting 1099 Forms or Submitting State Payroll Forms.