Submitting State Payroll Forms

Navigate to the Tax1099 interface at Tax1099 - Manage Forms to submit the saved forms for State Payroll.

To submit the saved forms for State Payroll, perform the following steps:

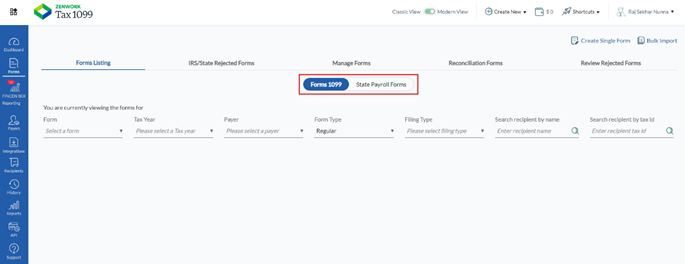

1. Login to the Tax1099 application.

2. From the left pane, select Forms.

The Mange Forms page appears. Click Unsubmitted Forms tab.

3. Select the State Payroll toggle.

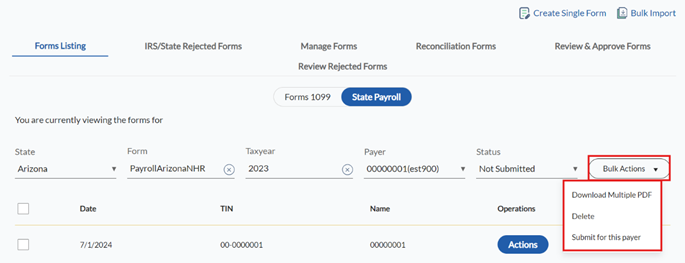

4. Select the state from the State list.

5. Select the form from the Form list.

6. Select the tax year from the Tax Year list.

7. Select the payer from the Payer list.

8. Select the status from the Status list.

The unsubmitted forms and Bulk Actions are displayed on the screen.

9. Select the form you want to submit.

10. (Optional) Select Download Multiple PDF from the Bulk Actions list to download multiple PDFs.

11. (Optional) Select Delete from the Bulk Actions list to delete the form.

12. Click Actions to view the form details.

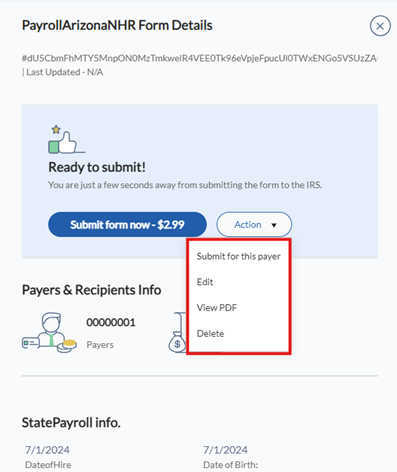

The form details pane appears.

13. (Optional) Select Edit to edit the form.

14. (Optional) Select View PDF to view the form in PDF format.

15. (Optional) Select Delete to delete the form.

16. Click Submit Form Now or select Submit for this Payer to submit the form.

The billing details pane appears.

17. Click Click here to calculate sales tax to select the billing address, enter your email address, and then click Calculate Sales Tax.

18. Click Pay Using Card to pay using your saved cards.

Or

Click Add Prepay Balance to add funds to your Prepay wallet.

19. (Optional) Enter the coupon number in the Coupon box, and then click Apply.

20. Click Pay Now.

The saved state payroll form is successfully submitted.