Submitting 1099 Forms

1099 forms are used by businesses and other entities to report payments made to individuals and entities that are not their employees.

To submit the saved 1099 forms, perform the following steps:

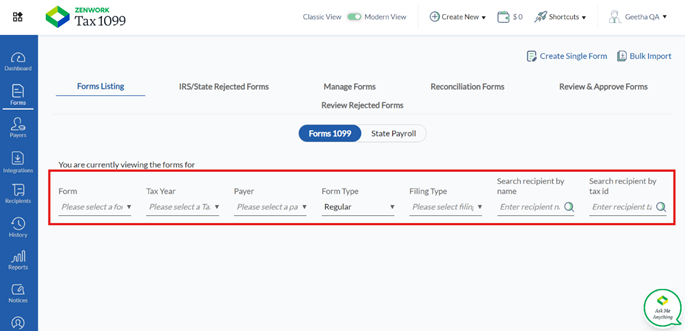

1. Login to the Tax1099 application.

2. From the left pane, select Forms.

The Manage Forms page appears. Click Unsubmitted Forms tab.

3. Select the tax year from the Tax Year list.

4. Select the payer from the Payer list.

5. Select the form type from the Form Type list.

6. Select the filling type from the Filling Type list.

7. Search recipients by name and tax ID.

The unsubmitted forms are displayed on the screen.

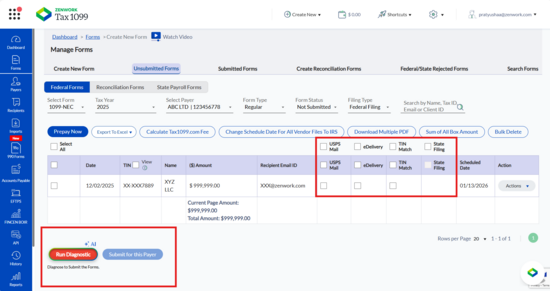

AI-Assisted Compliance Selection Workflow

This AI enhancement is designed to increase user compliance, reduce filing risks, and improve adoption of key value-added services such as USPS Mail, eDelivery, TIN Matching, and State Filing.

-

The system automatically selects all recommended compliance services by default:USPS Mail, eDelivery, TIN Match, and State Filing. Click Diagnostic.

2. The system automatically selects all recommended compliance services by default:

USPS Mail, eDelivery, TIN Match, and State Filing. Click Diagnostic.

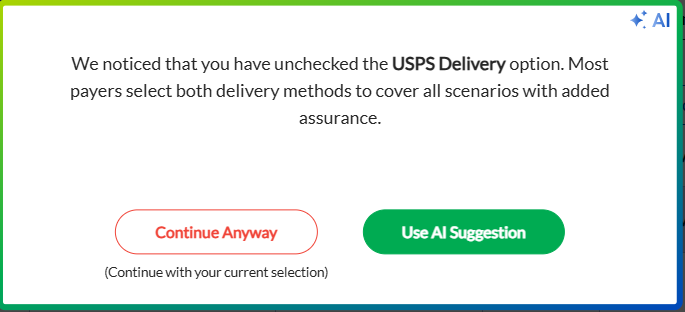

3. If the user unselects any recommended service:

-

The AI re-analyzes filing risks and compliance gaps.

-

The AI Diagnostic CTA is highlighted in red.

-

The Submit for This Payer button is temporarily disabled.

4. The user must review the AI Diagnostic panel, which explains potential risks such as delivery failures, state non-compliance, or IRS mismatches.

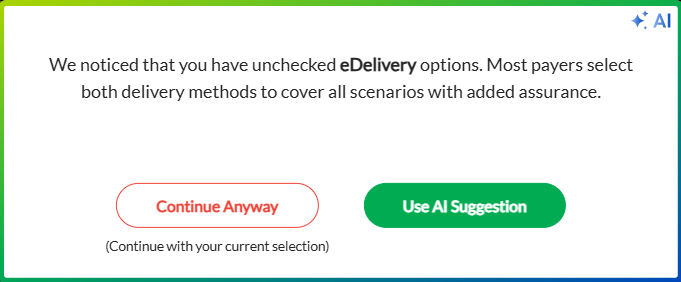

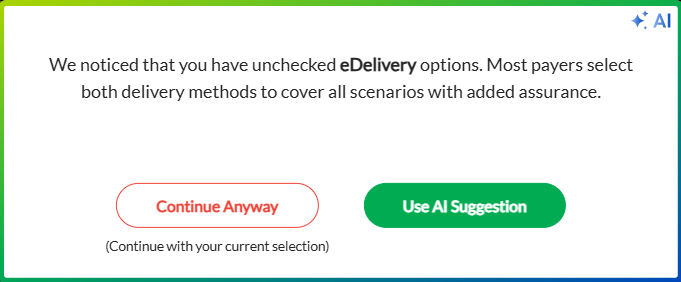

5. After reviewing the diagnostic, the user can choose one of the following:

-

Make Me Compliant / Use AI SuggestionAutomatically reselects all recommended services, resolves identified risks, and re-enables submission.

-

I Accept the Risk / Continue AnywayAllows the user to proceed without recommended services after acknowledging the risks.

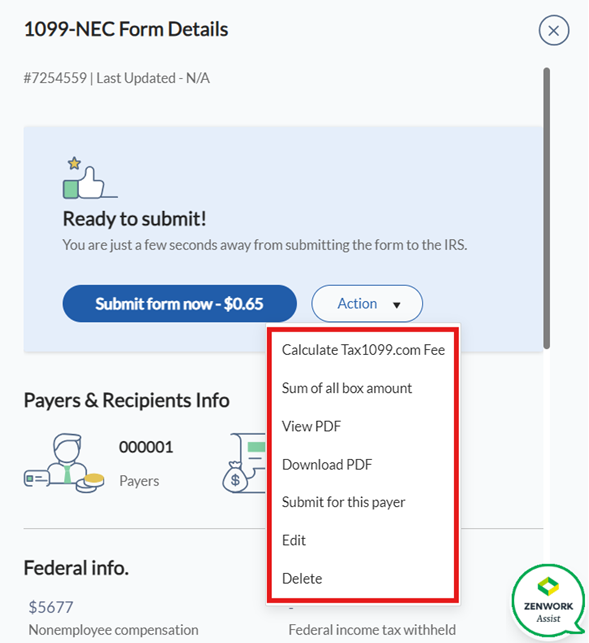

6. The Submit for This Payer button becomes active again. click Actions.

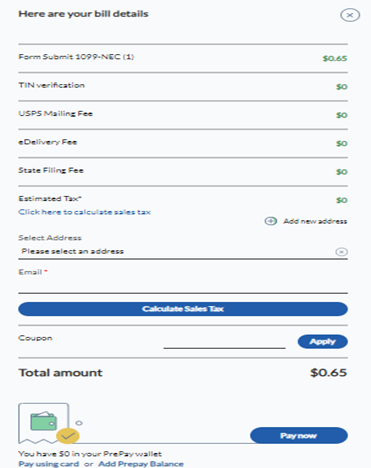

The form details pane appears.

· (Optional) Select Calculate Tax1099.com Fee from the Action list to view the fee details.

· (Optional) Select Sum of All Box Amount from the Action list to view the sum of all box amounts.

· Select View PDF from the Action list to view the details in a PDF.

· Select Download PDF from the Action list to download the PDF.

· Select Edit from the Action list to edit the form.

· Select Delete from the Action list to delete the form.

7. Select Submit for this Payer or click Submit Form Now to submit the form.

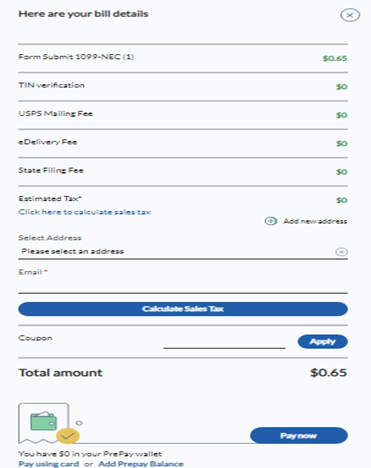

The billing details pane appears.

8. Click Click here to calculate sales tax to select the billing address, enter your email address, and then click Calculate Sales Tax.

9. Click Pay Using Card to pay using your saved cards.

Or

Click Add Prepay Balance to add funds to your Prepay wallet.

10. (Optional) Enter the coupon number in the Coupon box, and then click Apply.

11. Click Pay Now.

The saved 1099 form is successfully submitted.