Submitting BOI Forms

To submit the BOI forms, perform the following steps:

1. Login to the Tax1099 application.

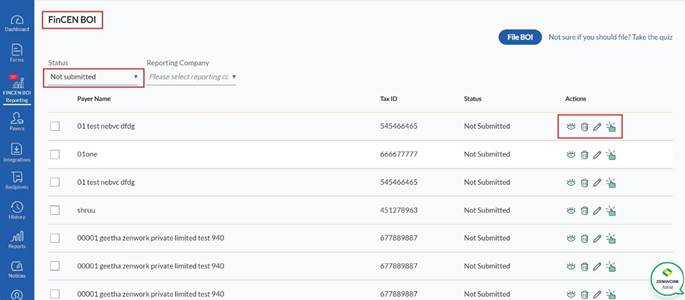

2. From the left pane, navigate to the FinCEN BOI Reporting.

The FinCEN BOI page appears.

3. Select the Not Submitted status forms from the Status list.

4. Select the reporting company you want to submit from the Reporting Company list.

All the BOI forms available for submission are displayed on the FinCEN BOI page.

5. Select the form you want to submit.

6. (Optional) Click the  View icon to view the BOI report in PDF format.

View icon to view the BOI report in PDF format.

7. (Optional) Click the  Delete icon to delete the BOI form.

Delete icon to delete the BOI form.

8. (Optional) Click the  Edit icon to edit the BOI form.

Edit icon to edit the BOI form.

9. Click the  Submit Form icon to submit the BOI form.

Submit Form icon to submit the BOI form.

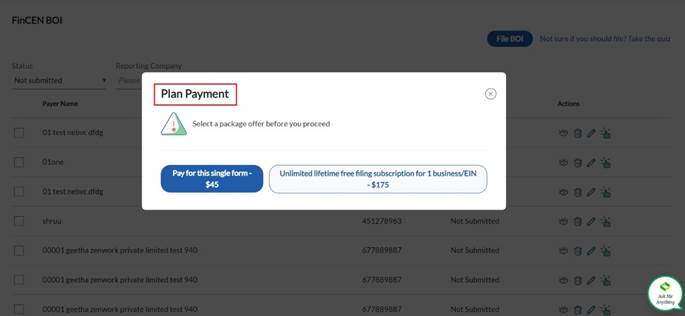

The Plan Payment dialog box appears.

10. Select the payment plan before proceeding to submit the form.

The billing details pane appears.

11. Calculate the sales tax be selecting the address and entering your email address.

12. (Optional) Enter the coupon code in the Coupon box if you have one, and then click Apply.

13. Verify the payment details and then click Pay Now.

The unsubmitted BOI form is successfully submitted.