Resubmitting State Rejected Forms

You can resubmit the state rejected forms in the State Resubmit page.

To resubmit the state rejected forms, perform the following steps:

1. Login to the Tax1099 application.

2. From the left pane, select Forms.

The Manage Forms page appears.

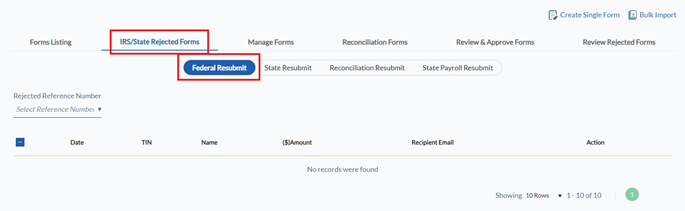

3. Select the Federal/State Rejected Forms tab.

The Federal Resubmit details appear.

4. Select the State Resubmit toggle.

The State Resubmit details appear.

5. Select the form from the Form list.

6. Select the payer from the Payer list.

7. Select the tax year from the Tax Year list and then click Search.

All the rejected state forms are displayed along with the state reference number, tax year, recipient TIN, recipient name, state, date, rejection reason, state withheld amount ID, and actions.

8. Select the appropriate form and perform the following:

· To download all PDFs, perform the following steps:

a. Click Download All PDFs.

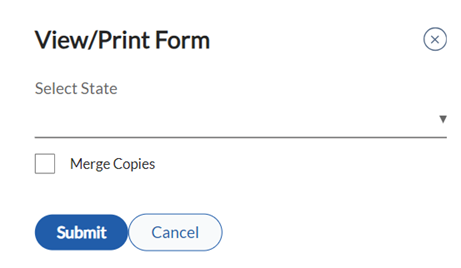

The View/Print Form dialog box appears.

b. Select the state from the Select State list.

c. (Optional) Select Merge Copies to merge all copies.

d. Click Submit.

· Click the  View/Print icon to view and print the form in PDF format.

View/Print icon to view and print the form in PDF format.

· To update the account number, perform the following steps:

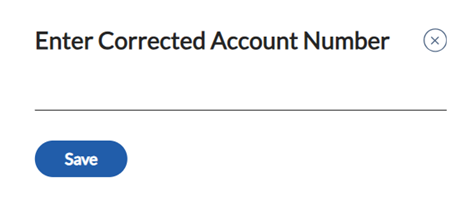

a. Click Update Account Number.

The Enter Correct Account Number dialog box appears.

b. Enter the account number, and then click Save.

9. Click Submit to resubmit the form.

The rejected state form is successfully resubmitted.