Resubmitting Reconciliation Forms

To resubmit the reconciliation forms, perform the following steps:

1. Login to the Tax1099 application.

2. From the left pane, select Forms.

The Manage Forms page appears.

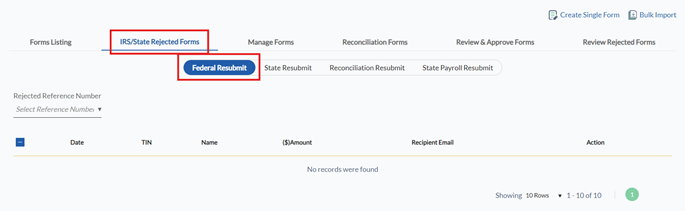

3. Select the Federal/State Rejected Forms tab.

The Federal Resubmit details appear.

4. Select the Reconciliation Resubmit toggle.

The Reconciliation Resubmit details appear.

5. Select the payer from the Payer list and then click Search.

All the rejected reconciliation forms are displayed along with the reference number, tax year, payer TIN, state, form name, rejection reason, state withheld ID, and actions.

6. Select the appropriate form and perform the following:

· Click the  View/Print icon to view and print the form in PDF format.

View/Print icon to view and print the form in PDF format.

· Click Update Withheld ID to update the withheld amount.

7. Click Submit to resubmit the rejected reconciliation form.

The rejected reconciliation form is successfully resubmitted.