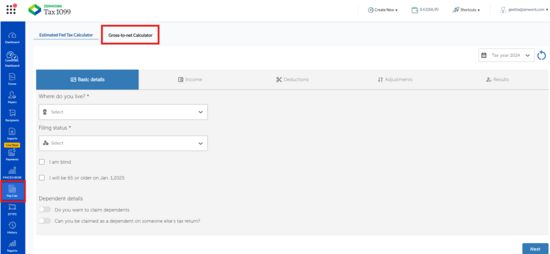

Gross-to-net Calculator

The Gross-to-Net Calculator in Tax1099 is a tool designed to help users convert gross income figures into net income. This calculation considers various deductions, taxes, and withholdings that affect take-home pay.

Navigate to the Tax1099 interface at Tax1099 - Pay Calculator-Gross Net Calculator to access the Gross to Net Calculator.

-

Login to Tax1099 application.

-

From the left pane, click Pay Calculator.The Estimated Federal Tax Calculator page appears.

-

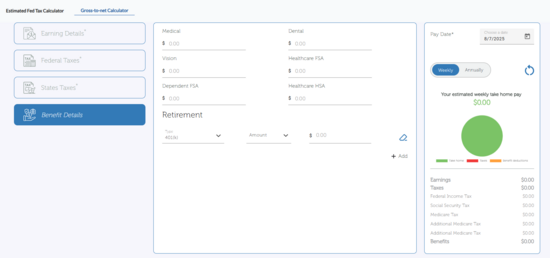

Select Gross-to-Net Calculator tab.The Gross-to-Net Calculator page appears.

-

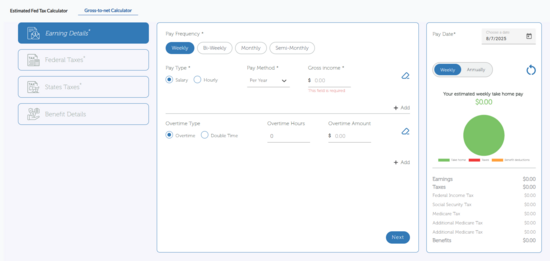

Select the section labelled Earning Details.

-

Under Pay Frequency.

-

Select one of the options:

-

Weekly

-

Bi-weekly

-

Monthly

-

Semi-Monthly

-

Under Pay Type, select one of the options:

-

Salary

-

Hourly

-

Under Pay Method, select one of the options:

-

Per Year

-

Per Pay Period

-

Under Gross Income, enter the gross income amount.

-

Under Overtime.

-

Select one of the options:

-

Overtime

-

Double Time

-

Under Pay Date, click on the calendar icon and select date.

-

View the summary of earnings displayed on the screen.

-

Check the breakdown of taxes displayed, which may include:

-

Federal Income Tax

-

Social Security Tax

-

Medicare Tax

-

Additional Medicare Tax

-

Ensure/Make sure all entered data is accurate and complete.

-

Click Next, the Federal Taxes page appears.

-

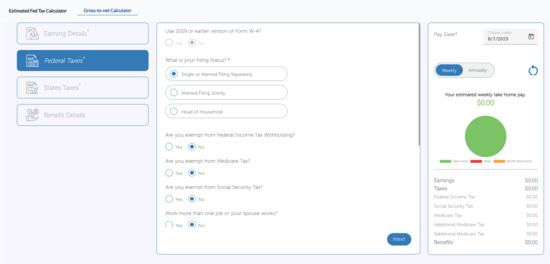

Under Use 2019 or earlier version of Form W-4.

-

Click the radio button next to Yes if you will be using the 2019 or earlier version.

-

Click the radio button next to No if you will not be using that version.

-

Specify Your Filing Status:

-

Click the radio button next to one of the following options:

-

Single or Married Filing Separately

-

Married Filing Jointly

-

Head of Household

-

Select Yes or No, under Are you exempt from Federal Income Tax Withholding.

-

Select Yes or No, under Are you exempt from Medicare Tax.

-

Select Yes or No, under Are you exempt from Social Security Tax.

-

Select Yes or No, under Work more than one job or your spouse works.

-

Enter the amount for dependents in Any Dependents Amount.

-

Enter the amount for other income if any exists in Any other Income Amount.

-

Enter the amount for deductions in Any Deduction Amount.

-

Enter any additional withholding amount in Any additional withholding amount.

-

Ensure that all selected options and entered amounts are accurate and complete.

-

Click Next, the State Taxes page appears.

-

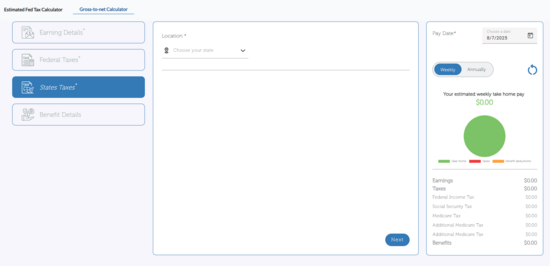

Select the state under Location.

-

Select the Withholding Percentage by clicking dropdown.

-

Enter the amount, in Any additional withholding amount field.

-

Under Are you exempt from State Income Tax Withholding.

-

Click the radio button next to Yes if you are exempt from state income tax withholding.

-

Click the radio button next to No if you are not exempt.

-

Ensure that all entered data, including location, withholding percentage, additional withholding amount, and exemption status, are accurate and complete.

-

Click Next, the Benefits Details page appears.

-

Enter the amount for medical expenses in Medical Expenses field.

-

Enter the amount for dental expenses in Dental Expenses field.

-

Enter the amount for vision expenses in Vision Expenses field.

-

Enter the amount for healthcare FSA in Healthcare FSA field.

-

Enter the amount for dependent FSA in Dependent FSA field.

-

Enter the amount for healthcare HAS in Healthcare FSA field.

-

Enter Retirement contributions:

-

Choose 401(k) from the dropdown menu.

-

Type the amount for retirement contributions.

-

Ensure that all entered medical expenses and retirement contributions are accurate and complete.