Estimated Fed Tax Calculator

The Estimated Federal Tax Calculator in Tax1099 is a valuable tool designed to help users accurately estimate their federal income tax obligations based on projected earnings and deductions.

Navigate to the Tax1099 interface at Tax1099 - PayCalculator-Estimated Fed Tax Calculator to access the Estimated Fed Tax Calculator.

-

Login to Tax1099 application.

-

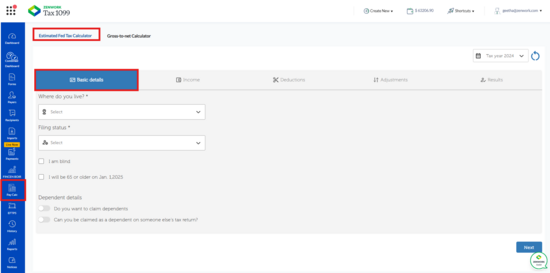

From the left pane, click Pay Calculator.The Estimated Federal Tax Calculator page appears.

-

On the Basic Details tab, perform the following steps:

-

Select the city and filing status.

-

Click the I am Blind checkbox to indicate that you meet the criteria for blindness.

-

Click the I will be 65 or older on Jan. 1,2025 checkbox to indicate that you will be 65 or older by the specified date.

-

On the Dependent details, perform the following steps:

-

Do you want to claim dependents, follow the steps below:

-

Click the toggle to switch it to Yes if you wish to claim dependents.

-

If you do not wish to claim dependents, ensure the toggle is set to No.

-

If you selected Yes, enter the number of qualifying dependent children in the provided field.

-

Enter the number of other qualifying dependents in the corresponding field.

-

Click the toggle to switch it to Yes if you wish to be claimed as a dependent on someone else’s tax return.

-

Click Next.

-

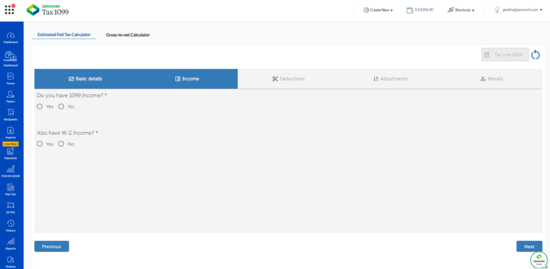

On the Income tab, perform the following steps:

-

Do you have 1099 income:

-

Click on the radio button to Yes to indicate that you have 1099 income.

-

Enter your Annual 1099 income amount in the designated field (e.g., $500.00).

-

Under Qualifying business expenses, enter the estimated amount for qualifying business expenses (e.g., $500.00).

-

Click on the radio button to No if you do not have any 1099 income.

-

Do you want to fill Schedule C, follow the steps below:

-

Click the radio button for Yes if you want to fill out Schedule C.

-

Click the radio button for No if you do not want to fill out Schedule C.

-

Annual W-2 Income, follow the steps below:

-

Click on the radio button to Yes to indicate that you have W-2 income.

-

Enter your annual W-2 income amount in the designated field (e.g., $500.00).

-

Enter the amount of federal income tax withheld (e.g., $200.00).e. Click Next, it redirects to deduction tab.

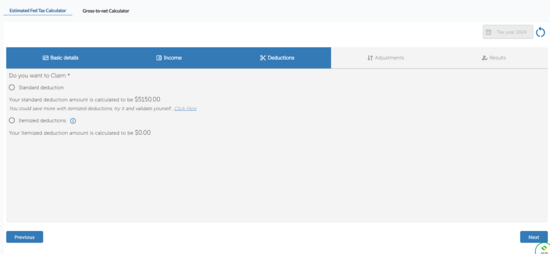

f. Under Do you want to Claim, follow the steps below:

f. Under Do you want to Claim, follow the steps below: -

Click on the radio button to "Standard deduction" to indicate that you want to claim this deduction.Note: The displayed standard deduction amount (for example, $16,550.00) for your records.

-

Click on the radio button to "Itemized deductions" if you choose to claim this type of deduction.

-

Observe the displayed itemized deduction amount (e.g., $0.00) for your records.g. Click Next, it redirects to Adjustments tab.

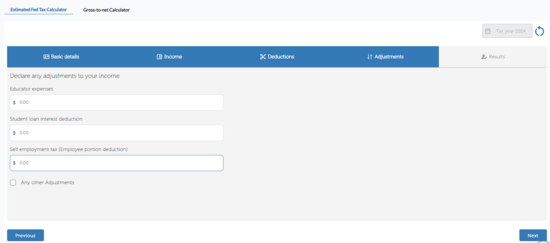

h. Under Declare any adjustments to your income, follow the steps below:

h. Under Declare any adjustments to your income, follow the steps below: -

Enter the amount for educator expenses (e.g., $100.00).

-

Enter the amount for student loan interest deduction (e.g., $50.00).

-

Enter the amount for self-employment tax (e.g., $0.00).i. Select the Any other Adjustments check box, follow the steps below:

-

Enter the name in the Adjustment Name field.

-

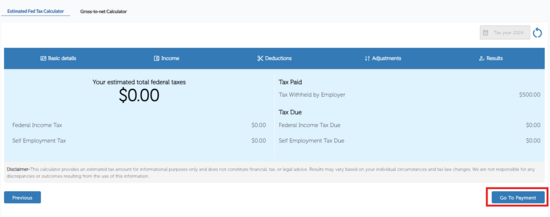

Enter the amount for the additional adjustment (e.g., $25.00).j. Click on this option to open new fields for entering more adjustments.k. Click Next, it redirects to Results page.l. Check the entire details and click Go to Payment.