EFTPS

The Electronic Federal Tax Payment System (EFTPS) is a secure method for businesses to pay federal taxes electronically. Tax1099 is a platform that allows users to file and manage tax documents, including Form 1099s. This guide will explain how to integrate EFTPS payments within the Tax1099 system, ensuring a seamless tax filing process.

EFTPS is a free service provided by the U.S. Department of the Treasury for paying federal taxes electronically. Users can schedule payments in advance, track payment history, and receive confirmation of payments made. It is particularly useful for businesses that need to manage various tax obligations efficiently.

-

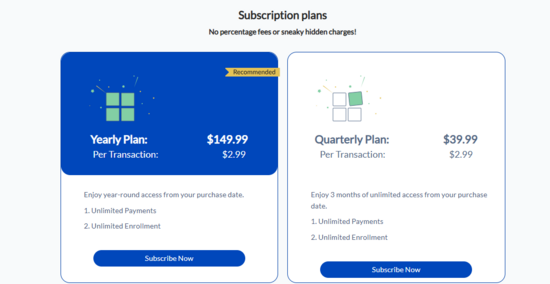

EFTPS Payments are now available at IRS Federal Tax Payment - Tax1099. Currently, EFTPS pricing as below:

-

Quarterly - $39.99 and $2.99 per filing.

-

Yearly - $149.99 and $2.99 per filing.