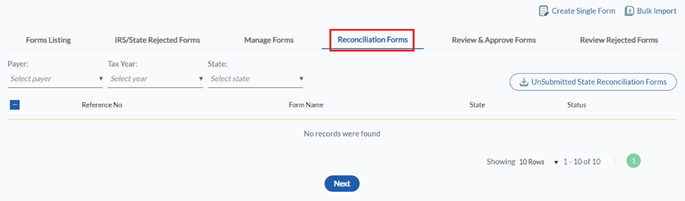

Reconciliation Forms

To submit the saved 1099 forms, perform the following steps:

-

Login to the Tax1099 application.

-

From the left pane, select Forms.The Manage Forms page appears. Click Unsubmitted Forms tab.

3. Select Reconciliation Forms toggle.

4. Select the payer from the Payer list.

5. Select the tax year from the Tax Year list.

6. Select the state from the State list.

7. All the unsubmitted state reconciliation forms are displayed along with the reference number, form name, state, and status.

8. Select the appropriate form and click Submit for this Payer.