Importing from BILL

BILL is a cloud-based business payments platform that simplifies and automates the way companies pay bills, send invoices, and manage their cash inflows and outflows.

To import from BILL, perform the following steps:

1. Login to the Tax1099 application.

2. Click Imports from the left pane, integrations partners page appears, and then click Bill icon.

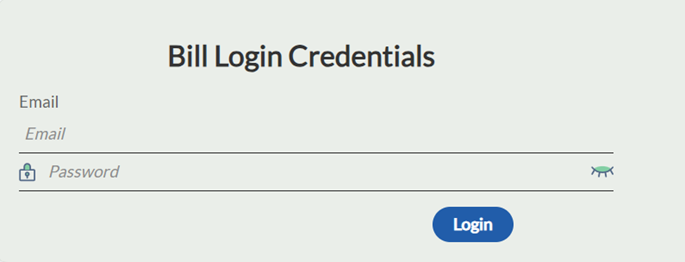

The Bill User Login page appears.

3. Enter the Bill user credentials in the respective boxes, and then click Login.

4. Follow the onscreen Import Instructions to add the company, vendors, and bills.

It displays the list of organizations along with the form type, tax year, and actions.

5. Select the tax year from the Tax Year list for the organization you want to import data for.

6. Select the form type from the Form Type list, and then click Load Data.

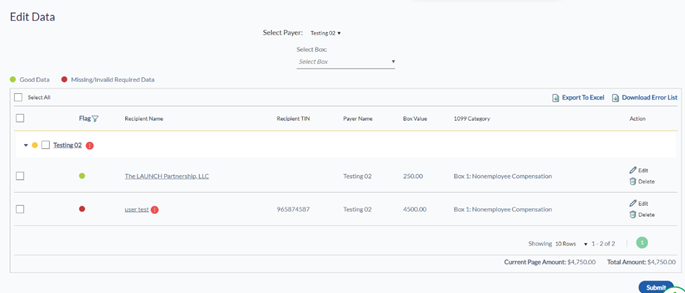

The Edit Data page appears.

7. Verify the imported data and correct any missing or incorrect recipient information by clicking on the recipient's name.

8. (Optional) Click the  Edit icon to edit the information.

Edit icon to edit the information.

9. (Optional) Click the  Delete icon to delete the payer information.

Delete icon to delete the payer information.

10. Click the Select All check box and then Next to proceed with the import.

The selected forms are successfully imported and listed on the Forms listing page for submission.

Note: If you manage multiple companies, import one company data at a time. After completing the import for one company, click Add New Company again to initiate the import for the next company.