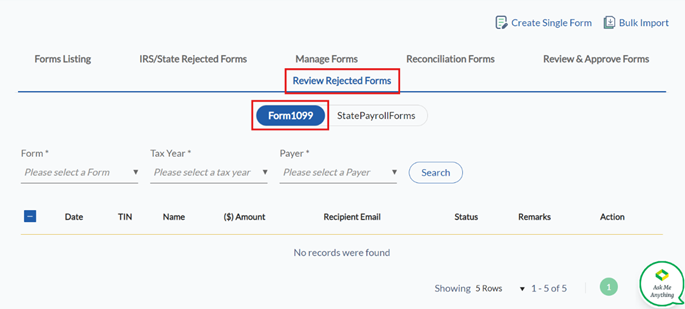

Review Rejected 1099 Forms

Navigate to the Tax1099 interface at https://web.tax1099.com/#/forms/reviewrejectedforms to review the rejected 1099 forms.

To review the rejected 1099 forms, perform the following steps:

1. Login to the Tax1099 application.

2. From the left pane, select Forms.

The Forms 1099 page appears.

3. Select the Review Rejected Forms tab.

The Form 1099 details appear.

4. Select the form from the Form list.

5. Select the tax year from the Tax Year list.

6. Select the payer from the Payer list.

7. Click Search.

All the 1099 forms that are rejected are displayed along with the date, TIN, payer name, amount, recipient email, status, remarks, and actions.

8. (Optional) Click the  View icon to view the review rejected form.

View icon to view the review rejected form.

9. Click the  Edit icon to edit the review rejected form according to the review rejected reason.

Edit icon to edit the review rejected form according to the review rejected reason.

10. (Optional) Click the  Delete icon to delete the review rejected form.

Delete icon to delete the review rejected form.

11. Select the appropriate form after making the required changes, and then click Resubmit Form.

The 1099 form is successfully resubmitted for review.