Importing from Zoho Books

Zoho Books allow businesses to manage their finances, including invoicing, expenses, inventory, and so on. It is used to generate 1099 reports for vendors or contractors. Tax1099 integrates with Zoho Books to import these 1099 reports directly for filing 1099-MISC or 1099-NEC forms. This integration streamlines the process of reporting non-employee compensation to the IRS.

To import the data from Zoho Books, perform the following steps:

1. Login to the Tax1099 application.

2. Click Imports from the left pane, integrations partners page appears, and then click Zoho Books.

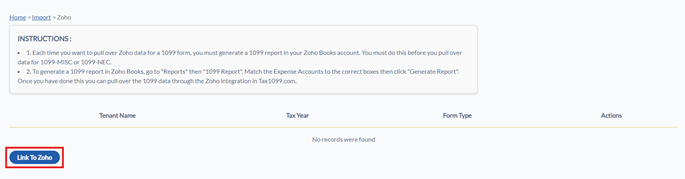

The Zoho Books integration page appears.

3. Follow the onscreen Import Instructions available on the Zoho Books integration page to import Zoho data for a Tax1099 form.

After generating the report in Zoho, you can import the data from Tax1099.

Tax1099 Zoho integration page displays the list of organizations.

4. Select the form type and tax year for the organization data you want to import, and then click Import.

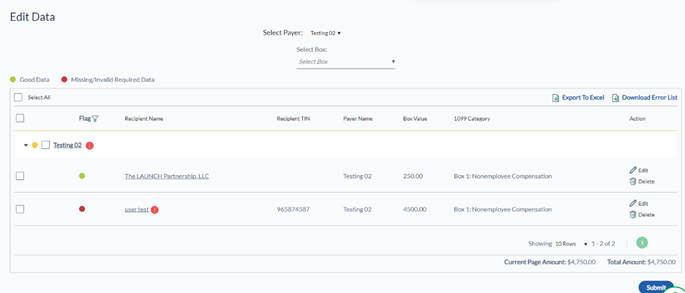

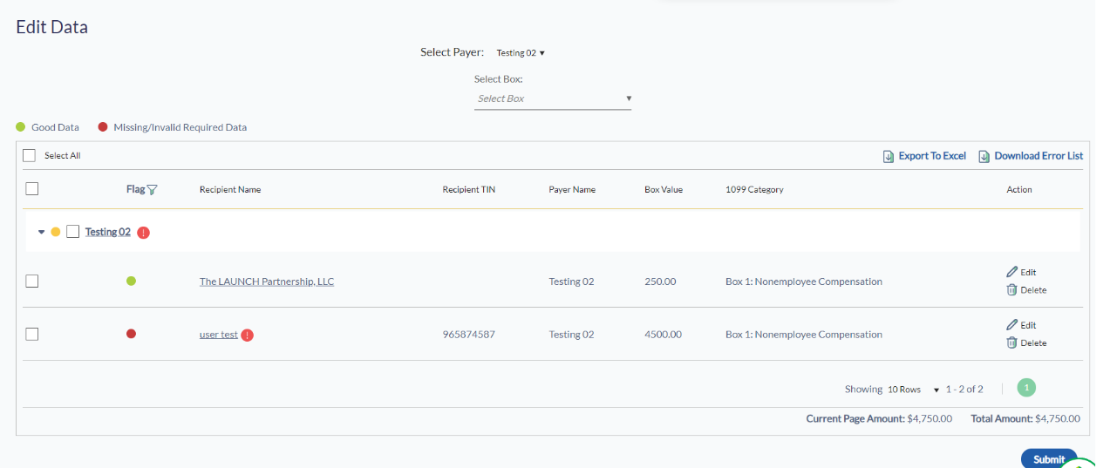

The Edit Data page appears.

5. Verify the imported data and correct any missing or incorrect recipient information by clicking on the recipient's name.

6. (Optional) Click the  Edit icon to edit the information.

Edit icon to edit the information.

7. (Optional) Click the  Delete icon to delete the payer information.

Delete icon to delete the payer information.

8. Click the Select All check box and then Next to proceed with the import.

The selected forms are successfully imported and listed on the Forms listing page for submission.