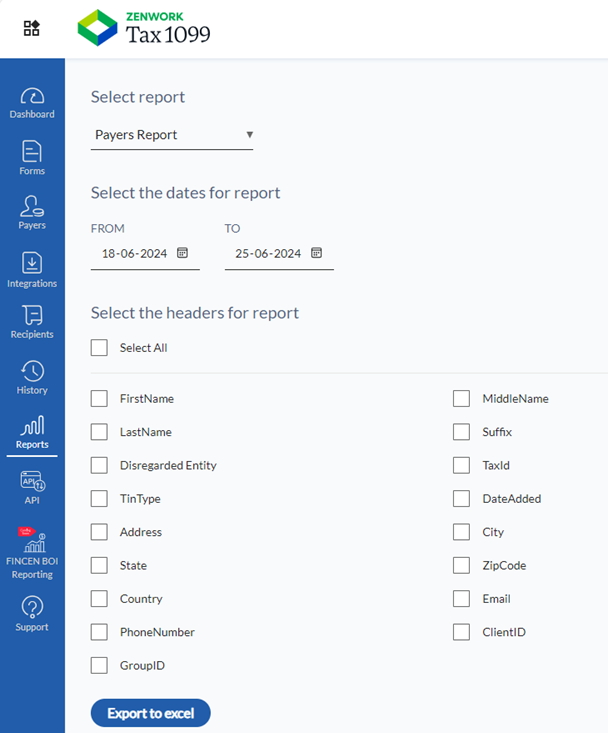

Downloading Reports

To download the reports in an Excel file, perform the following steps:

1. Login to the Tax1099 application.

2. From the left pane, scroll down and select Reports.

The Reports page appears.

3. Select the appropriate report you want to download from the Select Report list.

4. Select the payer from the Select Payers list.

Note: The Select Payers box appears only if you select the reports such as Recipient Report, TIN Match Report, W9 Report, W8 Report, Opt-In Request Report, Unsubmitted Forms Report, and Email Request Status.

5. Select the user from the Select User list.

Note: The Select User box appears only if you select the Payers Report By User report.

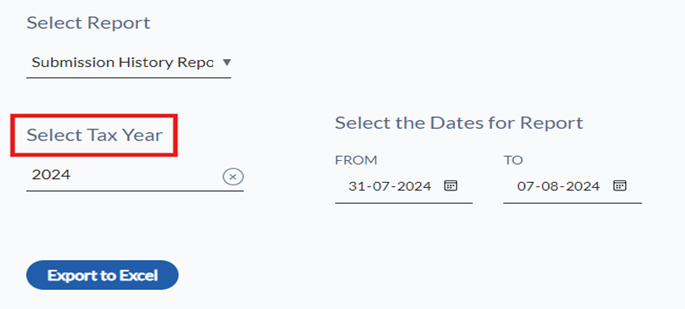

6. Select the tax year from the Select Tax Year box.

Note: The Select Tax Year box appears only if you select the reports such as Unsubmitted Forms Report, Submission History Report, Forms Delivery Report, Generate Invoice, and Email Request Status.

7. Select the state and form from the State and Form boxes respectively.

Note: The State and Form boxes appear only if you select the State Payroll Submission History Report.

8. Select the From and To dates for the report you want to download.

9. Select the appropriate headers for the reports.

10. Click Export to Excel.

The report is successfully downloaded to your local system.